June is both Pride Month and the anniversary of the 2015 Obergefell decision that legalized marriage equality[1] . As such, it is a good time to examine the state of same-sex couples in the Atlanta region. How prevalent are same-sex couples? How do same-sex marriage rates compare to those for opposite-sex marriage? And how does the Atlanta region compare to other major metropolitan areas?

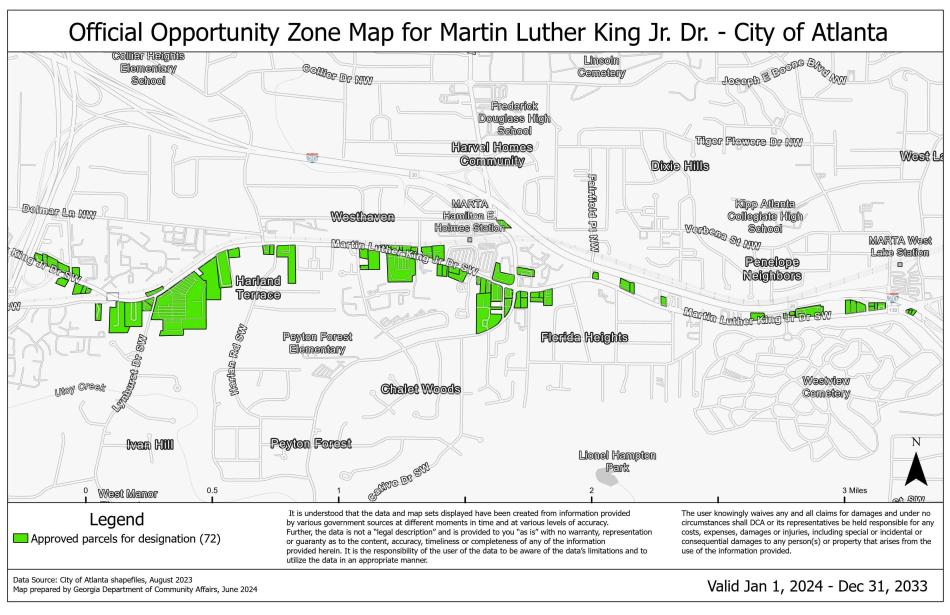

To address these questions, we use data from the most recent (2022) release of the American Community Survey 1-year estimates. Figure 1 shows the total number of same-sex households[2] for each of the 20 largest (by population) metropolitan areas in the United States.

Figure 1: Same-Sex Households in the Top 20 US Metros

It should come as no surprise that New York, Los Angeles, and Chicago– the three largest metro areas in terms of total population and total households– also have the largest numbers of same-sex households. But from there, the two sets of rankings diverge. Washington DC, Miami, and San Francisco occupy positions 4, 5, and 6 with regards to the number of same-sex couples despite being only the 7th, 9th, and 12th largest metros respectively. And Atlanta, which recently moved up to #6 in terms of population, occupies only the #11 spot for the number of same-sex couples.

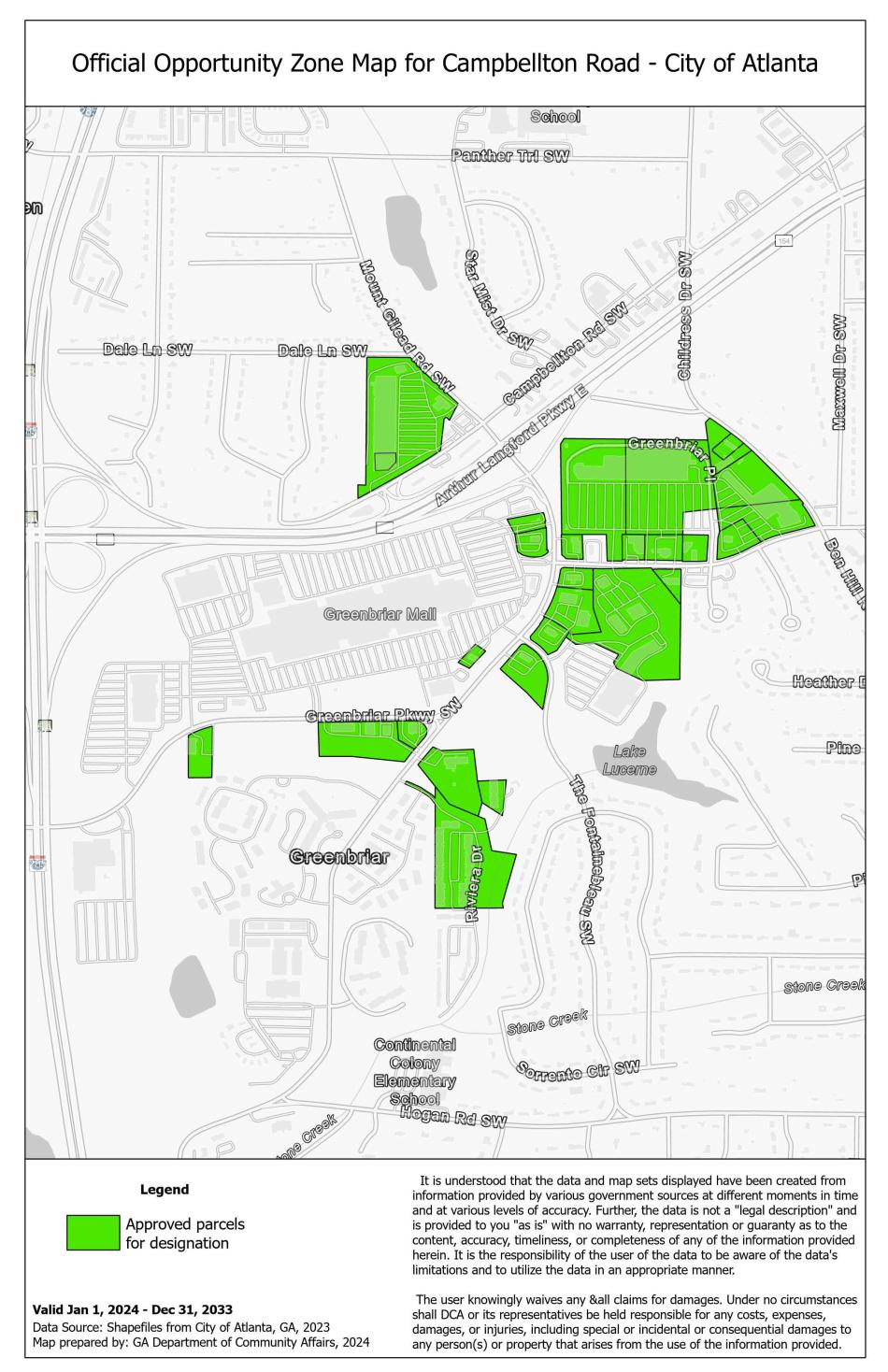

Figure 2 below examines marriage rates among same-sex and opposite-sex for these same metros. Bars are sorted by the size of the gap between marriage rates between the two groups.

Figure 2: Marriage Rates in the Top 20 Metros

Figure 2 reveals that same-sex couples are much less likely to marry than opposite-sex couples—even seven years after the Obergefell decision. The gap in marriage rates in these metros ranged from a high of 35.2 points in Denver to a low of 15.2 points in Baltimore. Atlanta had the second highest gap at 34.6 points.

What accounts for these differences? One potential explanation is the legal environment in each state.[3] Figure 3 below shows marriage rates of same-sex couples by state. Red bars represent states where an existing ban on same-sex marriage would likely return to force if Obergefell were ever overturned, while green bars represent states where marriage equality would likely remain protected.

Figure 3: Same-Sex Marriage Rates by State

As Figure 3 shows, eight of the ten states with the highest marriage rates among same-sex couples provide statutory protection for such marriages. But this theory only provides a partial explanation: some states lacking protection like Wyoming have high same-sex marriage rates. And others like New Mexico and Washington, DC have relatively low rates despite providing such protections. Still, it does appear to matter overall: the mean marriage rate among same-sex couples is 61.1% among states where same-sex marriages would remain protected should Obergefell ever be reversed, as compared with only 55.7% across those states where these unions would likely be banned.

Footnotes

[1] Through the 5-to-4 decision in Obergefell v. Hodges, the Supreme Court in 2015 that failure of states to allow and recognize same-sex marriages violated the Equal Protection and Due Process clauses of the 14th Amendment, thus opening the way to nationwide marriage equality. For more on this decision, see https://constitutioncenter.org/the-constitution/supreme-court-case-library/obergefell-v-hodges. However, some states had legalized same-sex marriage prior to Obergefell— Massachusetts was first, in 2003. And other states, including Georgia, retain laws on the books– though nullified by the Supreme Court decision– banning same-sex marriage.

[2] The Census Bureau Table B11009, that looks directly at coupled households by type. This table breaks coupled households down into married vs. cohabiting couples, same-sex vs. opposite sex couples, and within same-sex couples differentiates between male householder and male partner vs. female householder and female partner. Unfortunately, B11009 is only available for states, regions, and the nation as a whole. For metro areas, therefore, we utilize a nearly equivalent proxy, the number of people who are the spouse or cohabiting partner of the head of household, which can be found in Table B09019.

[3] For more information on the legislative environment in each state as reported in this graph, please see https://www.politifact.com/article/2022/jul/20/what-states-would-ban-same-sex-marriage-if-supreme/.

The post Unveiling the Union: Same-Sex and Opposite-Sex Marriage in Major Metros appeared first on 33n.